Consolidation may additionally be an efficient strategy for these going through mounting monetary stress and looking to simplify their obligations.

Consolidation may additionally be an efficient strategy for these going through mounting monetary stress and looking to simplify their obligations. However, it is vital to evaluate whether or not this transfer aligns with your long-term monetary go

Once all documents are in order, borrowers can proceed with the application. This sometimes includes completing a web-based form or visiting a lender’s workplace. It’s advisable to ask questions and make clear any uncertainties during this stage to make sure a full understanding of the mortgage process and its implicati

Potential Risks and Considerations

While

24-Hour Loan loans supply quick relief, they come with sure risks that borrowers must contemplate. High-interest charges are often characteristic of these loans, leading to important financial burdens if not paid back promptly. In some circumstances, the interest rates can exceed these of conventional loans, making it very important for debtors to fully understand the price of borrow

n Initially, understanding your financial state of affairs is crucial. This consists of listing all property and liabilities and reviewing the total debt. Next,

이지론 create a finances that accommodates any compensation plans. Seek skilled recommendation if necessary, and begin to coach yourself on monetary administrat

Recovery is not merely about eliminating debt; it includes restructuring finances, rebuilding credit score, and infrequently, a reevaluation of spending habits. Strong emphasis ought to be placed on growing a price range that accommodates new compensation plans while permitting for important day by day bills. Recognizing the long-term effects of bankruptcy on credit scores is essential, as these scores considerably influence future borrowing potential and interest ra

Furthermore, BePick typically options articles about monetary literacy, tips about budgeting, and advice on managing loans effectively. This holistic approach ensures that readers not only discover appropriate mortgage options but in addition understand the larger context of financial managem

Importance of Financial Education

Financial training performs a pivotal position within the Bankruptcy Recovery journey. Gaining information about financial administration, funding methods, and credit score scores can considerably empower individuals who've skilled chapter. The understanding of fundamental financial ideas can prevent future pitfalls and decrease the danger of falling back into financial difficult

Furthermore, local charities or community organizations generally provide small emergency grants or zero-interest loans to these in want. Exploring such avenues might provide not only quick assistance but also less monetary stress in the lengthy

Challenges Women Face in Accessing Loans

Despite the rising availability of Women's Loans, challenges stay for so much of women looking for monetary assistance. One of the predominant points is the persistent gender pay hole, which may have an effect on a woman's capacity to safe a mortgage. Lenders typically assess revenue when determining eligibility, and decrease average incomes can hinder entry to fund

It’s also essential for debtors to assess their financial state of affairs earlier than buying a mortgage. While the prospect of fast cash is enticing, taking up debt with no clear compensation strategy can lead to additional financial strain. A thorough understanding of your borrowing capacity and reimbursement plan will make sure that a 24-hour mortgage serves its supposed object

Debt consolidation loans offer a strategic approach to managing multiple money owed successfully. By combining numerous debts right into a single payment, borrowers can simplify their financial obligations, possibly decrease interest rates, and reduce the stress related to multiple payments. Understanding how these loans work is crucial, as they could be a priceless software for regaining management of funds. The intricacies of debt consolidation can sometimes be daunting, but with the right info and guidance, people can navigate this course of to enhance their monetary well-be

Understanding 24-Hour Loans

24-hour loans are sometimes designed to provide quick monetary help to debtors who require instant cash. These loans can are obtainable in varied forms, corresponding to payday loans, private loans, or cash advances. The major attraction lies in their speedy approval processes, permitting people to receive funds in as little as one business day. However, borrowers ought to be conscious of the terms and conditions related to these loans to keep away from undesirable surprises. The rise of digital lending platforms has further streamlined the applying course of, making it easier than ever to safe a 24-hour l

The site options detailed articles, guides, and comparisons of different lenders, enabling potential debtors to navigate the complex lending panorama seamlessly. With a user-friendly interface, it’s easier for people to teach themselves on the pros and

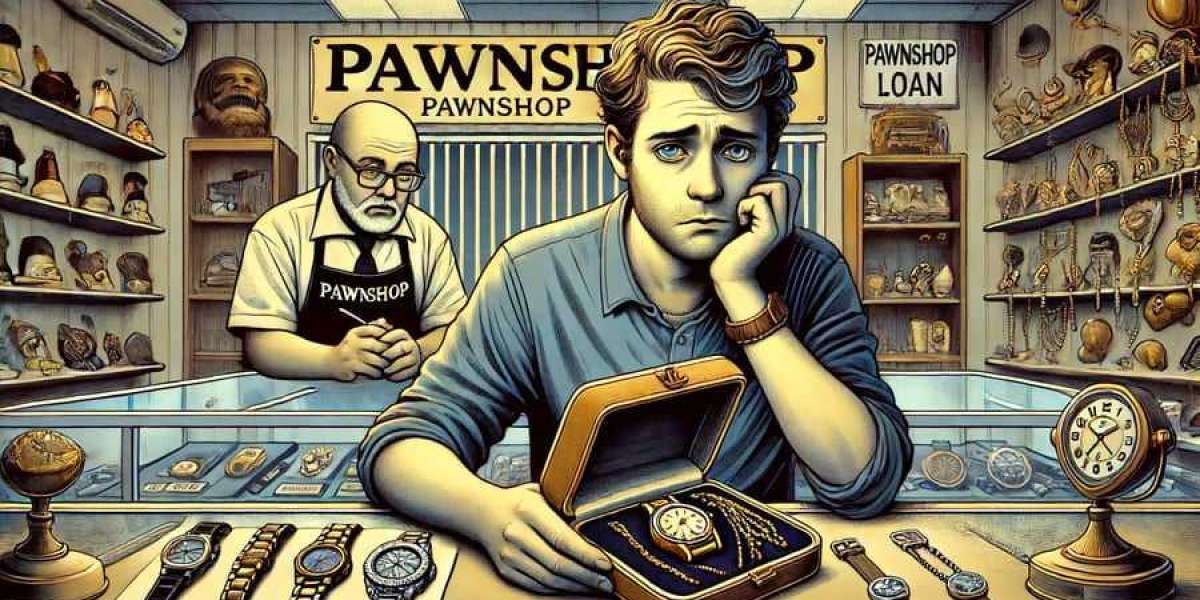

Pawnshop Loan cons of short-term lo